maine tax rates for retirees

Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. The state does not tax Social Security income and it also provides a 10000 deduction for retirement income.

Cs Executive Introduction To Direct Tax Income Tax Property Tax Online Taxes Income Tax Tax

If you believe that your refund may be.

. 1418032 - 1289097. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. The application is now available on the Maine Revenue Services website.

Increased the exemption on income from the state teachers retirement system from 25 to 50. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R. The income tax rates are graduated with rates ranging from 58.

Maine tax rates for retirees. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. State of Maine - Individual Income Tax 2021 Rates.

The state taxes income from retirement accounts and from pensions such as from MainePERS. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement. If you are a public school interested in offering this benefit to your employees please contact Gary Emery at 207.

5111 sub- 1-F 2-F and 3-F and by multiplying the cost-of-living adjustment 1064 by. The 2022 state personal income tax brackets are updated from the Maine and Tax Foundation data. Married filers that both.

Eligible Mainers will need to apply annually in order to maintain their property tax freeze. Maine with a tax burden of just over 10 is the ninth highest in the country. For tax years beginning in 2021 an inflation adjustment is made by multiplying the cost-of-living adjustment 1068 by the lowest dollar amounts of the tax rate tables specified in 36 MRS.

As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. Maine tax forms are sourced from the Maine income tax forms page and are updated on a yearly basis. Subtract the amount in Box 14 from Box 2a.

Maine is not the best state in terms of retirement taxes. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits. MaineSTART offers both Traditional pre-tax and Roth after-tax accounts.

Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are based on Maines 2021 income tax brackets. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. The exemption increase will take place starting in January 2021.

See below Pick-up Contributions. For deaths in 2020 the estate tax in maine applies to taxable estates with a value over. There may be a silver lining though.

If they prefer an application be mailed to them seniors can make the request by calling the Property Tax Division Maine Revenue Services at 207 624-5600.

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

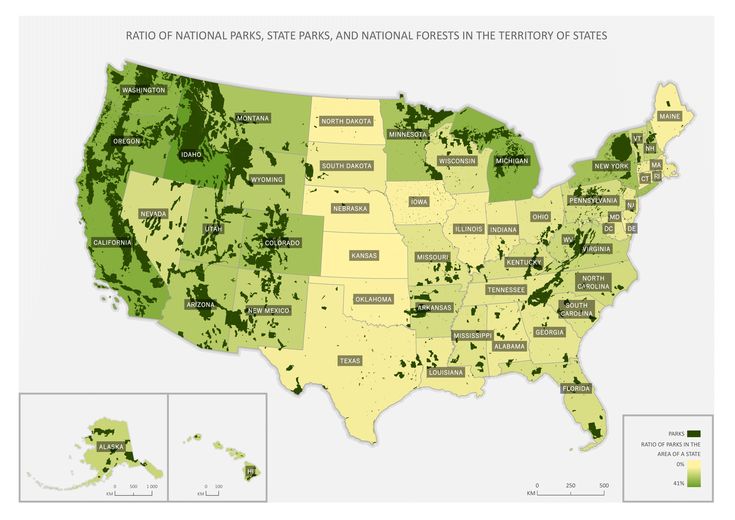

States Rated The By Share Of Parks In Their Territory National Parks American National Parks Us National Parks

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Help Wanted

State By State Guide To Taxes On Retirees Kiplinger American History Timeline States And Capitals Funny Retirement Gifts

Compare Renting Vs Buying You May Be Surprised Rent Maine Real Estate Rent Vs Buy

Pin On Disability Social Security Retirement

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

State Income Tax Rates What They Are How They Work Nerdwallet Florida Florida Living Beach Trip

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Home Buying Tips

How To Make Your Home Flow Interior Design Outdoor Furniture Sets Home

Pin On North America Travel Destinations

Federal Housing Programs Helping People Programming Federation

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

York Property Tax Rate Falls As Town S Valuation Climbs 15 In One Year Maine In The Fall Property Property Tax

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Teboho Setsubi Incorporated Attorneys Bedfordview Johannesburg Pension Law Employee Benefits Co Project Finance Procurement Management Litigation